Unemployment tax rate calculator

In this easy-to-use calculator enter your. A Contribution Rate Notice Form UC-657 is mailed to employers at the end of each calendar year and shows the contribution rate.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Once you submit your application we will.

. The Connecticut Department of Labor has announced that the method used to calculate the 2022 unemployment tax rates will be modified because of Public Act 21-5. In order to be eligible for partial unemployment benefits your hours must have been reduced to less than your normal work hours through no fault of your own you must work 30 or fewer. Employer As Form UIA 1771 showed the following.

To calculate the amount of unemployment insurance tax. State law instructs ESD to adjust the flat social tax rate based on the employers rate class. Form UIA 1771 Tax Rate Determination gives all the information the employer needs to calculate the unemployment tax rate.

Notifying Employers of Their UC Tax Rates. 52 rows Most states send employers a new SUTA tax rate each year. The Premiums Calculator may save you time and hassle and help ensure you pay the correct amount of unemployment insurance premiums.

Including federal and state tax rates withholding forms and payroll tools. Wyoming State Unemployment Insurance SUI Wyoming Wage Base. High rates of unemployment in the state can produce higher tax rates in subsequent years.

State your business is headquartered in. If youre starting a new small. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs.

Average annual salary per employee. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Simply enter the calendar year your premium.

Your household income location filing status and number of personal. An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes. The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week.

For 2022 Wyoming unemployment insurance rates range from 009 to 85 with a taxable wage base of up to 2770000 per employee per year. Calculate UI and ETT. Conversely low unemployment can produce lower tax rates.

ALL USERS MUST REGISTER IN THE NEW SYSTEM AT ONE OF THE LINKS BELOW. The flat social tax is capped at 050 for 2021 050 for 2022 075 for 2023 085 for 2024 and. Generally states have a range of unemployment tax rates for established employers.

Welcome to WYUI our new Unemployment Insurance system. If you have already registered in WYUI. UI tax and ETT are calculated based on the taxable wages up to the UI taxable wage limit of each employees wages per year and are paid by the employer.

At the beginning of the year you.

1wxmydejhzto9m

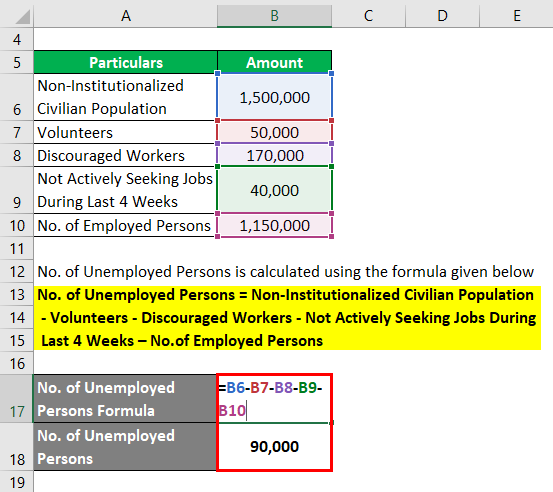

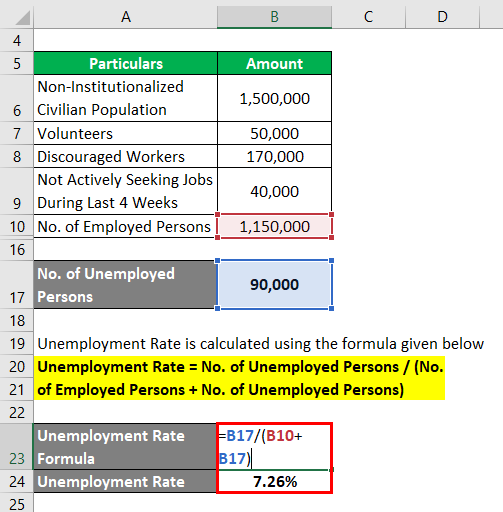

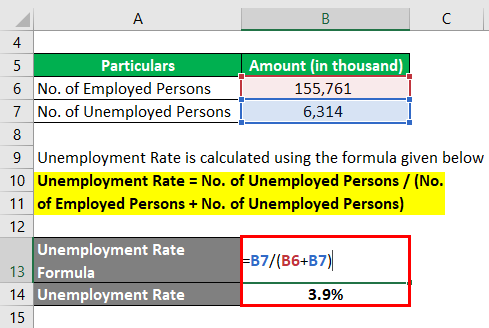

Unemployment Rate Formula Calculator Examples With Excel Template

Llc Tax Calculator Definitive Small Business Tax Estimator

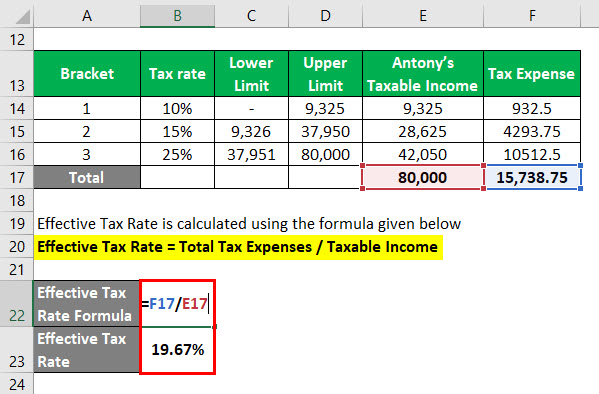

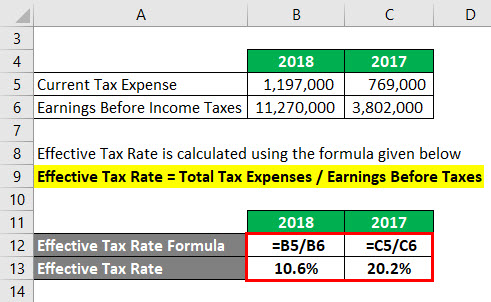

Effective Tax Rate Formula Calculator Excel Template

Unemployment Tax Changes Throughout The Country In 2022 First Nonprofit Companies

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Effective Tax Rate Formula Calculator Excel Template

Futa Tax Overview How It Works How To Calculate

Unemployment Rate Formula Calculator Examples With Excel Template

Unemployment Rate Formula Calculator Examples With Excel Template

Dor Unemployment Compensation

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Unemployment Rate Formula Calculator Examples With Excel Template

Esdwagov Calculate Your Benefit

Payroll Tax Calculator For Employers Gusto