Tax off paycheck calculator

Your marital status determines which formula your employer will use to calculate the tax to be withheld from your paycheckThis is because the tax rates and standard deduction amounts are different depending on whether you are married or single. The State of Florida collects its version of an unemployment tax that it calls the reemployment tax.

Avanti Income Tax Calculator

Property Tax Rates in Arkansas.

. Your results will only account for federal income tax withholding. 2022 federal income tax calculator. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. This calculator is intended for use by US. Taxes on alcoholic beverages in Vermont vary depending on the type of beverage.

You withhold it from their paychecks based on their withholding selection in their W-4 form. Thats where our paycheck calculator comes in. Whether you deposit FUTA tax quarterly or annually youll use Form 940 to summarize the tax you owe.

It is not a substitute for the advice of an accountant or other tax professional. FUTA or federal unemployment tax. Get a new W-4 Form and fill it out completely based on your situation.

Pay FUTA Unemployment Tax. Submit your new W-4 to your payroll department. Unlike your 1099 income be sure to input your gross wages.

The calculator is updated with the tax rates of all Canadian provinces and territories. While gasoline purchases in Vermont are not subject to sales tax there is an excise tax on fuel in Vermont. Will my investment interest be deductible.

Florida Payroll Taxes and Rules Florida Reemployment Tax. Offer period March 1 25 2018 at participating offices only. Learn how to calculate and adjust your tax withholding with the Form W-4 so that you can get more money per paycheck instead of a large tax refund every year.

You can use the calculator to compare your salaries between 2017 and 2022. The Florida Reemployment Tax minimum rate for 20221 is 0129 and can be as high as. You will need to pay 6 of the first 7000 of taxable income for each employee per year.

Thousands of satisfied clients are repeatedly generating stubs till. Overtime pay is supported with straight double triple and time and a half pay rates. May not be combined with other offers.

City Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. The table below shows average effective property tax rates as well as median property tax payments and home values for every county in Arkansas. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

To qualify tax return must be paid for and filed during this period. Vermont Gas Tax. How much of my social security benefit may be taxed.

Your household income location filing status and number of personal exemptions. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. Computes federal and state tax withholding for paychecks.

Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. The Paycheck Calculator may not account for every tax or. The taxes that are withheld from employee wages are.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. ESmart Paychecks free payroll calculator is a paycheck calculator that can be used to calculate and print paychecks and paystubs. You can start things off by doing some of the following.

Deduct and Match FICA Taxes. Flexible hourly monthly or annual pay rates bonus or other. Meaning your pay before taxes and other payroll deductions are taken out.

There is no head of household status for withholding formulas. Other paycheck deductions are not taken into account. Capital gains losses tax estimator.

1 online tax filing solution for self-employed. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal. W-2 income.

How to use Free Calculator. Go for it now and wave-off to traditional paycheck making procedure by replacing it with a faster reliable and efficient pay stub generator. Usage of the Payroll Calculator.

So the easy 1-2-3 step process is. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Receive 20 off next years tax preparation if we fail to. Our salary calculator has been updated with the latest tax rates. Use our online pay stub calculator tool and know about your salary.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The program also provides benefits to workers who take time off due to life events eg pregnancy.

If you can pay off your balance within 120 days it wont cost you anything to set up an installment plan. Figure out your new withholding on through the IRSs tax withholding estimator. The amount of tax each employee owes varies based on their salary household income filing status.

Compare taxable tax-deferred and tax-free investment growth. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Should I adjust my payroll withholdings.

This box is optional but if you had W-2 earnings you can put them in here. Another way of looking at property taxes is the average effective rate. If you pay state unemployment taxes you are eligible for a tax credit of up to 54 making your FUTA tax rate effectively 06.

Infant Growth Charts Child Height Predictor Percent Off Calculator Compare Two Loans Mortgage Calculator Loan Calculator Sales Tax Calculator Days Between Dates Interest Equations. If you cannot pay off your balance within 120 days setting up a direct debit payment plan online will cost 31 or 107 if set up by phone mail or in-person. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

This refers to the average annual property tax payment divided by the average property value. How much self-employment tax will I pay. If the idea of a big one-off bill from the IRS scares you then you can err on the side of.

FUTA tax is the sole. Taxes are unavoidable and without planning the annual tax liability can be very uncertain. Paycheck calculator to determine weekly gross earnings or income.

The tax that employers have to pay for is. If not using direct debit then setting up the plan online will cost 149. Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour.

Americas 1 tax preparation provider. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. The state tax on regular gasoline totals 1210 cents per gallon and the state tax on diesel fuel is 28 cents per gallon.

It can also be used to help fill steps 3 and 4 of a W-4 form. If you terminate or lay off an employee you must pay the employee their final paycheck within six calendar days or the next workday if the sixth day is on a day when the business is usually closed.

How To Calculate Net Pay Step By Step Example

Tax On Pay Calculator Sale 60 Off Www Wtashows Com

Net To Gross Calculator

Take Home Salary Calculator Store 50 Off Www Wtashows Com

Paycheck Calculator Online For Per Pay Period Create W 4

Net Pay Calculator On Sale 54 Off Www Wtashows Com

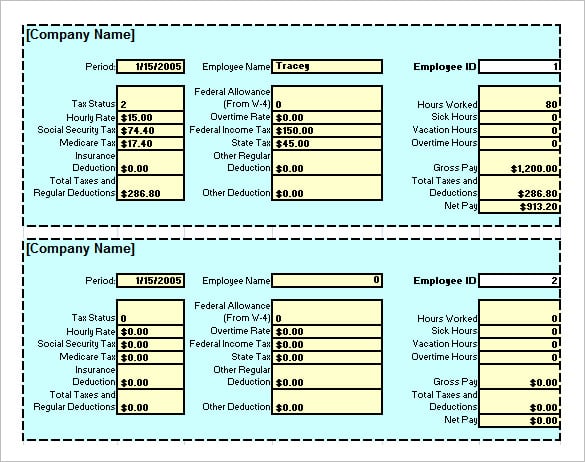

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Free Online Paycheck Calculator Calculate Take Home Pay 2022

The Measure Of A Plan

Mathematics For Work And Everyday Life

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

What Is The Net Pay For A Gross Salary Of 120 000 Usd In California Quora

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Payroll Tax Calculator Best Sale 59 Off Www Wtashows Com

Payroll Tax Calculator Shop 55 Off Www Wtashows Com

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator